What is Data Remediation?

Empowering Enterprise Intelligence:

Infotel’s Data Remediation for Better Decisions

In today’s data-driven world, organizations rely on structured data for decision-making, compliance, and operational efficiency. The poor data quality, outdated records, and regulatory challenges can lead to financial risks and inefficiencies. This is where structured data remediation plays a crucial role.

What is Data Remediation?

Data remediation refers to the process of cleaning, organizing, and improving the data quality to ensure the data accuracy, completeness, and consistency. There is a misconception that data remediation means deletion of business data that is no longer required but the key initiative of data remediation is to correct data, which typically involves replacing, modifying, removing redundant data, cleansing or deletion of unnecessary data. Essentially, data remediation is about making data reliable and trustworthy for decision-makers and compliance.

An excess of unstructured data leads to security vulnerabilities, causing compliance issues, increases costs of storage, and impacts day-to-day business activities.

Understanding Data Remediation in Banking

Data remediation in banking, especially in the context of Know Your Customer procedures, is the process of identifying, cleaning, and rectifying inaccurate, incorrect, or irrelevant data to improve data quality and ensure regulatory compliance.

Key Areas Where Data Remediation is Essential

- Regulatory Compliance: It ensures adherence to GDPR, RBI regulations, and the other regulatory compliances.

- Risk Management: Data remediation helps to reduce fraud, credit risk, and operational inefficiencies.

- Data Migration & Digital Transformation: Data remediation is crucial for data migration as it supports data quality, reduces cost, and minimises risk. Similarly, it also helps organisations by providing clean, high-quality data for digital transformation initiatives, such as analytics, machine learning, and automation.

- Customer Experience: Enhances personalization and trust with clean, structured data.

- Operational Efficiency: Reduces redundancies, lowers costs, and improves reporting accuracy.

- As banks and financial institutions need to comply with regulations like GDPR, PCI DSS, and RBI guidelines, data remediation helps to rectify the outdated or incorrect records to prevent compliance risks.

- When banking firms must adopt cloud solutions or modern banking platforms, legacy data contains inconsistent information, where remediation takes place to clean and structure data before migration, preventing errors.

- Banks rely on accurate data for loan processing, KYC checks, and credit scoring. Poor data quality can cause delays in approvals or cause errors in financial assessments.

Benefits of Data Remediation in Banking

- Regulatory Compliance

Banks need to keep the customer data updated to comply with KYC regulations, which helps prevent financial crimes. - Data Quality

Data remediation ensures that the data is accurate, reliable, and complete, which is essential for making informed decisions and conducting business operations. - Risk Management

Data remediation helps in identifying and mitigating risks associated with inaccurate data, such as money laundering or financial crimes. - Enhanced Customer Experience

Accurate and reliable data leads to an improved customer experience, facilitating seamless transactions and improved service. - Reduced Risks of Data Breaches

Data remediation helps to prevent unauthorized access to sensitive data and reduce the risk of data breaches by identifying and removing the data that is no longer required.

Process of Remediation in Banking

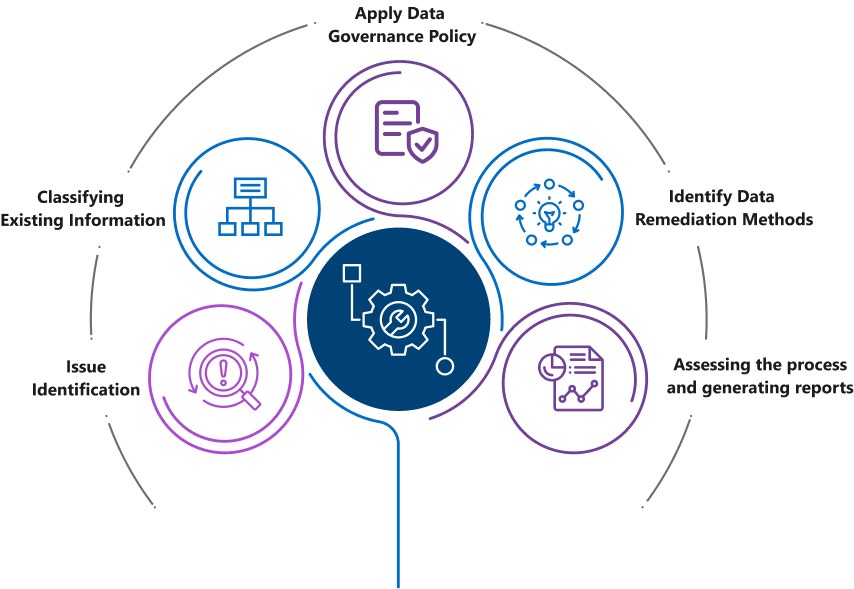

The process of remediation in banking involves a systematic approach to identify, address, and resolve issues that may occur within the organisation. Some of the typical steps involved in remediation in banking are

- Issue Identification

The initial step in the remediation process is to identify the issue or problem through thorough investigations, audits, or assessments that need to be addressed. This could be due to compliance violation, operational inefficiency, customer complaints, or a cybersecurity incident. - Classifying Existing Information

Segregating data based on usability and importance is needed where the data must be deleted safely without impeding day-to-day business that includes

i. Redundant, obsolete, and trivial data

ii. Dark data which was no longer in use

iii. Duplicate, inaccurate, or outdated data - Apply Data Governance Policy

Data governance policy can be applied where the policies can enforce what data is outside of policy, which requires remediation on a priority basis. - Identify Data Remediation Methods

Discovering the appropriate data remediation strategies is crucial once you have a complete data inventory. Choose the appropriate remediation technique that is most suitable for each type of data, and some of the common methods include data modification, deletion, indexation, migration, and cleansing. - Assessing the process and generating reports

The final stage involves looking back at the data remediation procedure and evaluating the results, which can be helpful to create reports and use them as a basis for future remediations.

Navigating Data Complexity with Infotel

Data remediation isn’t just about the data deletion – it’s about strategic risk management, improving operational efficiency, and future-proofing financial ecosystems. At Infotel India, we work closely with the financial institutions to solve multi-layered challenges in GDPR compliance, legislation, and secure data governance.

From bulk data deletion to whitelisting strategies and anonymization, our data remediation solutions empower financial institutions to handle data integrity and reduce the risk of regulatory compliance. Our in-house product deepeo, a data management solution, helps you keep on top of GDPR compliance, and it takes your data management one step further by allowing you to analyse data while keeping client identities anonymous.

The reality of managing intricate datasets requires a precision-driven approach, ensuring that aged, redundant, or deeply nested data is handled with care. From bulk data deletion to whitelisting strategies and anonymization, our solutions empower financial institutions to maintain data integrity while reducing regulatory risk.

Infotel’s Smart Approach to Data Remediation

Infotel’s smart approach to Data Remediation, powered by deepeo offers a holistic GDPR compliance solution tailored for banking and financial systems. By leveraging deepeo’s automated data management, Infotel ensures smooth data deletion, anonymization, and compliance monitoring. Some of the key benefits include:

- Rule-based data deletion: Removes outdated records while handling regulatory integrity.

- Data anonymization: Anonymization feature of deepeo helps to preserve analytical value while protecting sensitive information. While GDPR is crucial, data anonymization feature of deepeo helps extensively with data governance, ensuring businesses meet evolving privacy standards.

- Real-time reporting: Provides a consolidated view of your data, enabling customers to visualise the risk exposure in real time.

- Seamless integration: It works across multiple databases without disrupting existing workflows.

By adopting a precision-driven approach, Infotel empowers financial institutions to handle intricate datasets, eliminate regulatory risks, and enhance data security—all while strengthening operational efficiency.

Infotel, là où vous êtes

Infotel, là où vous êtes